Trading refers to buying and selling financial assets like stocks, crypto currencies, forex, or commodities with the goal of making a profit.

How to Start Trading: Step-by-Step Guide

- Choose Your Market

- Decide what you want to trade: stocks, crypto, forex, or commodities.

- Learn the Basics

- Understand key concepts like buy/sell orders, charts, candlesticks, and risk management.

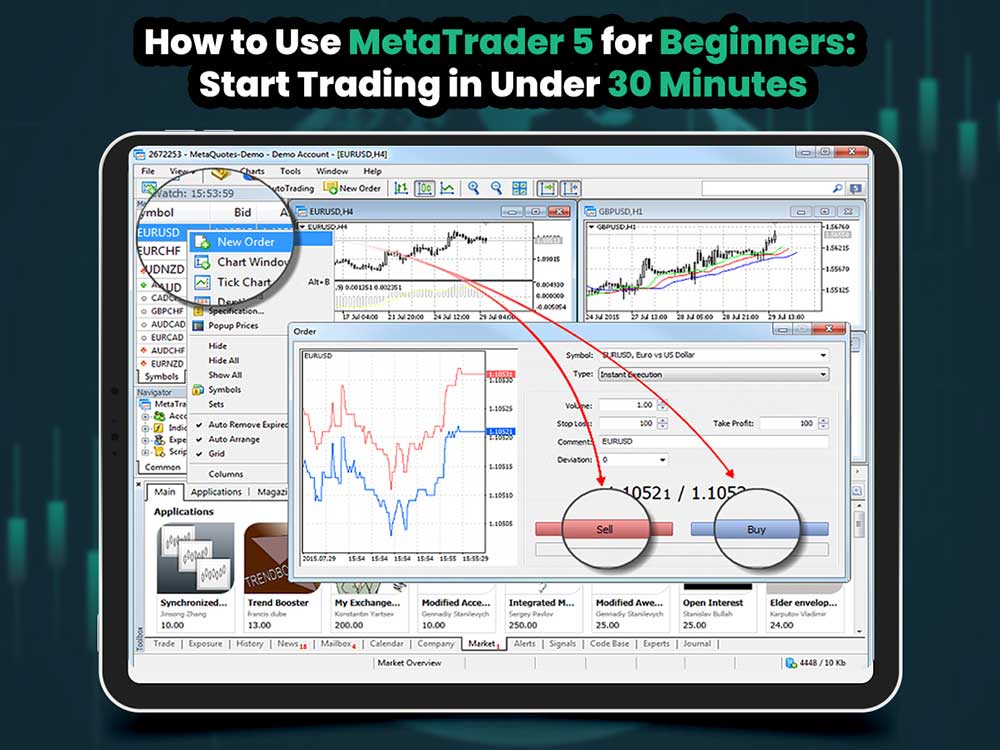

- Pick a Reliable Trading Platform

- For stocks: Robinhood, eToro, Interactive Brokers

- For crypto: Binance, Coinbase, KuCoin

- For forex: MetaTrader, OANDA, FXTM

- Create an Account

- Register, complete KYC (identity verification), and link your payment method or wallet.

- Start with a Demo Account (Optional)

- Many platforms offer practice trading with fake money to help you learn without risk.

- Fund Your Account

- Deposit money or crypto to start trading.

- Develop a Strategy

- Choose your style: day trading, swing trading, or long-term investing.

- Start Trading Small

- Place your first trade with a small amount and monitor the results.

- Manage Your Risks

- Use stop-loss orders, never trade more than you can afford to lose.

- Track Your Performance

- Review trades and learn from your mistakes.

Tips for Beginners Starting Their Trading Journey

1. Start with Education, Not Emotion

- Many new traders jump into the market hoping to get rich quick.

- Instead, take time to read trading books, watch tutorials, or take online courses.

- Focus on understanding trends, market psychology, and technical analysis.

2. Avoid Overtrading

- One of the biggest mistakes beginners make is trading too often or chasing the market.

- Instead, wait for clear signals and only enter trades that meet your strategy criteria.

3. Keep a Trading Journal

- Record every trade: why you entered, when you exited, and what you learned.

- This helps you spot patterns, track performance, and improve over time.

4. Diversify, Don’t Gamble

- Don’t put all your money into one asset (e.g., one stock or coin).

- Spread your capital across different assets or sectors to reduce risk.

5. Stay Updated with Market News

- Use news platforms like Bloomberg, CoinDesk, or Investing.com to follow trends and announcements that affect prices.

- Economic reports, interest rates, and political news can impact markets dramatically.

Common Questions About Starting Trading

Q: Do I need a lot of money to start trading?

A: No. Many brokers allow you to start with as little as $10–$100, especially in crypto and forex.

Q: Is trading risky?

A: Yes. Trading involves financial risk. That’s why it’s important to start small and learn first.

Q: How long does it take to learn trading?

A: It varies. Some basics can be learned in a few weeks, but mastering trading takes months or years.

Q: What should I trade as a beginner?

A: Many beginners start with crypto or stock trading, as these markets are easier to access.

Basic Terms Every Trader Should Know

| Term | Meaning |

| Buy (Long) | Expecting the price to go up |

| Sell (Short) | Expecting the price to go down |

| Stop-Loss | An automatic order to limit your loss if the market goes against you |

| Take-Profit | An order to close the trade once a target profit is reached |

| Volume | How much of the asset is traded over a period |

| Volatility | The degree of price fluctuations |

| Support/Resistance | Key levels where prices often bounce or reverse |

Mistakes to Avoid When Starting Trading

- ❌ Trading without a plan

- ❌ Letting emotions drive decisions (fear/greed)

- ❌ Ignoring risk management

- ❌ FOMO (Fear of Missing Out) buying during market hype

- ❌ Not setting stop-loss orders

Final Advice

Trading is not a get-rich-quick scheme. It requires discipline, patience, and constant learning. Start small, build your strategy, and grow over time. Even the best traders lose sometimes — the key is to manage risk and stay consistent.